Bangkok, Thailand, 14 May 2014 -- Thoresen Thai Agencies Public Company Limited ("TTA" or "the Group") announced its best second quarter results in since 2008, with net profits of THB 183 million for the period ended 31 March 2014. The strong performance has been driven by continued profitability in three out of the Group's four core businesses, namely Mermaid Maritime Public Company Limited ("Mermaid"), Thoresen Shipping Singapore Pte. ("Thoresen Shipping") and Baconco Co., Ltd ("Baconco"). The fourth core business, Unique Mining Service Public Company Limited ("UMS") reported a loss of THB 35 million as a result of the continued effort to rebalance its capital structure and strengthen its financial health.

THORESEN SHIPPING

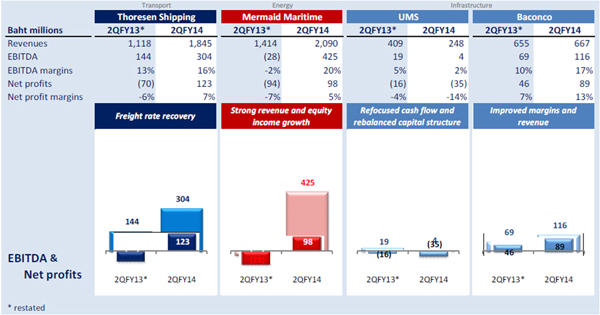

Despite the January-March period typically being low season in the dry bulk shipping industry, Thoresen Shipping's net profit surged 218% year-on-year to THB 123 million, the unit's strongest second quarter result in four years of operation, on the back of improved revenue generation and continued control on costs. With Thoresen Shipping's operational strengths, its low-season 2QFY14 net profit surpassed its 1QFY14 net profit.

Overall, Thoresen Shipping's revenue increased 65% year-on-year to THB 1,845 million, partially driven by an increased number of vessels under operation (average 39.8, up from 29.4 in Q2 2013). EBITDA grew 111% year-on-year to THB 304 million, compared to THB 144 million during the same period last year. Lower depreciation expenses resulting from impairments performed during the fourth quarter of 2013 resulted in net profit reaching THB 123 million, compared to a net loss of THB 70 million in Q2 2013.

The unit achieved day rates (TCE) of USD 10,528 per day compared to USD 8,651 during the same period last year, representing a 22% improvement year-on-year. Thoresen Shipping's owner expenses of USD3,962 per day remained well below (23% or USD1,159 lower) the industry average of USD 5,121 per day while total costs were also further reduced by 8% year-on-year to USD 8,745 per day compared to USD 9,511 per day during the same period last year.

MERMAID

Mermaid delivered a 6-year high, reporting net profit of THB 98 million, despite its low season. The business delivered revenue growth of 48% to reach THB 2,090 million, driven by performance improvements in both subsea and drilling businesses.

Both subsea and drilling businesses delivered significant performance improvements. The effect of seasonality was reduced due to long-term contracts being in place for both businesses. Revenue growth was driven by higher contributions from both businesses as a result of having more full service contracts in place and higher day rates. Utilization rates of the subsea fleet decreased slightly year-on-year from 56% to 51% during Q2 2014.

Mermaid's drilling business continued to perform well, delivering a further increase in equity income, which reached THB 281 million during the second quarter, significantly up from losses of THB 27 million in the second quarter of 2013. The result continues to benefit from Mermaid's 33.8%-owned associate company Asia Offshore Drilling having all three of its high-specification jack-up rigs on three-year contracts with Saudi Aramco.

UMS

UMS reported a net loss of THB 35 million, flat compared to Q1 2014. The businesses cash flow position improved significantly from sales of inventories. Over the past two quarters, UMS has focused on rebalancing its capital structure and strengthening its financial position. Net interest-bearing debt was reduced by THB 393 million from THB 1,139 to THB 746 million in Q2 2014.

BACONCO

Baconco achieved all-time-high net profit, with an increase of 95% year-on-year to a record THB 89 million, as a result of strong cost management and effective sales and marketing plans. Profitability in the fertilizer business was boosted by a decrease in raw materials costs, while the business was able to maintain selling prices. Sales volume of fertilizer also increased slightly by 2% year-on-year to 40,690 tonnes as Baconco focused its sales on high margin formula, and on expanding into new international markets. Baconco's warehouse revenues increased 79% year on year, following the launch of the additional warehouse space of Baconco 5 in February 2013.

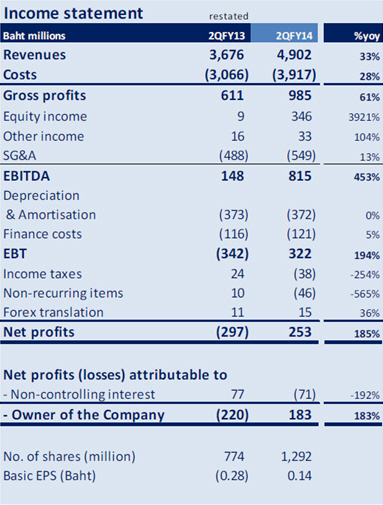

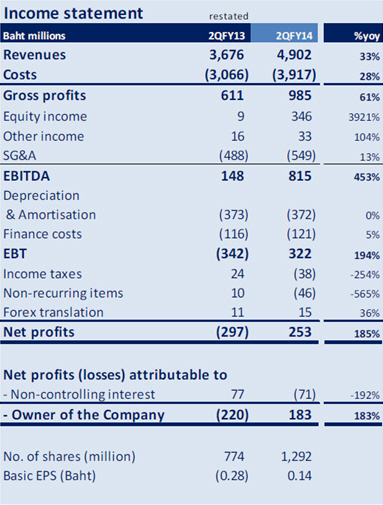

RESULTS

TTA's net profits for the second quarter grew 183% year-on-year, to reach THB 183 million compared with net losses of THB 220 million during the same period last year. The Group's consolidated revenues rose 33% year-on-year to THB 4,902 million, while EBITDA increased to THB 815 million, up more than four-fold year-on-year due to a combination of gross profit expansion, a strong increase in equity income, and only a slight increase in SG&A.

TTA President & CEO Mr. Chalermchai Mahagitsiri stated, "This has been another strong quarter for TTA, with impressive results both at the top and bottom line. Indeed, this is our strongest second quarter since 2008. Our transportation and energy groups have performed particularly well as a result of high utilization rates, long contracts and strong cost management.

"A highlight of the second quarter was the strong and full support we received from our rights offer, which successfully raised THB 4,173 million to fund our business expansion plans. The rights offer was oversubscribed by 7%, which is testament to the confidence our shareholders have in our ability to deliver enhanced performance and greater shareholder returns.

"The proceeds from the rights offer enable us to take better advantage of market opportunities across our key subsidiaries and associate companies, through short and medium term investment opportunities. As part of this, during the second quarter, we invested heavily in both the capacity and geographical footprint of Thoresen Shipping. We have added five vessels to our fleet since the beginning of 2014 and have opened a new office in South Africa, to better serve the needs of our customers. We plan to further expand our fleet to minimum of 25 vessels (up to 30 vessels) by the end of 2014, depending upon the availability of suitable used vessels in the market.

"Our energy business has continued to deliver, securing long-term, high margin contracts. We are optimistic on the outlook for the oil and gas services industry. The demand for jack-up drilling rigs has improved globally and demand for premium jack-up rigs remains strong, particularly in Asia and the Middle East. We will maintain our focus on signing more of these high-value contracts, and will be able to further solidify our position upon delivery of our two tender drilling rigs and one dive support vessel in 2016.

"Baconco also has continued to perform well, achieving another record high, and we are looking for further growth opportunities in both fertilizer and warehousing businesses.

"While UMS has delivered significant improvements in its cash flow position, as a result of inventory sales, its performance continues to be impacted by access challenges related to the Samut Sakorn plant. We continue working towards regaining full access."