2019 |

2020 |

2021 |

|

Statement of Financial Position (Million Baht) |

|||

|---|---|---|---|

Total Assets |

33,473 | 31,028 | 38,947 |

Cash under Management (4) |

7,085 | 7,700 | 11,483 |

Other Current Assets |

5,229 | 4,623 | 7,279 |

Tangible Assets (5) |

13,946 | 14,334 | 15,481 |

Other Non-Current Assets |

7,213 | 4,372 | 4,704 |

Total Liabilities |

10,874 | 11,838 | 14,547 |

Interest Bearing Debt (6) |

8,260 | 9,216 | 10,451 |

Other Liabilities |

2,614 | 2,622 | 4,096 |

Total Equity |

22,599 | 19,191 | 24,400 |

Key Financial Ratio |

|||

Gross Margin (7) (%) |

20.4% | 21.1% | 31.7% |

EBITDA Margin (%) |

12.4% | 5.5% | 24.7% |

Net Profit Margin (to TTA) - normalized (%) |

3.6% | -15.2% | 17.4% |

Net Profit Margin - normalized (%) |

1.4% | -26.3% | 16.7% |

Return on Total Assets - normalized (%) |

0.6% | -10.4% | 10.5% |

Return on Equity - normalized (%) |

3.0% | -11.3% | 20.6% |

Current Ratio (Times) |

3.15 | 2.25 | 2.83 |

Debt to Equity Ratio (8), (9) (Times) |

0.17 | 0.26 | 0.10 |

Net interest Bearing Debt to Equity (10), (11) (Times) |

0.05 | 0.08 | -0.04 |

2019 |

2020 |

2021 |

||

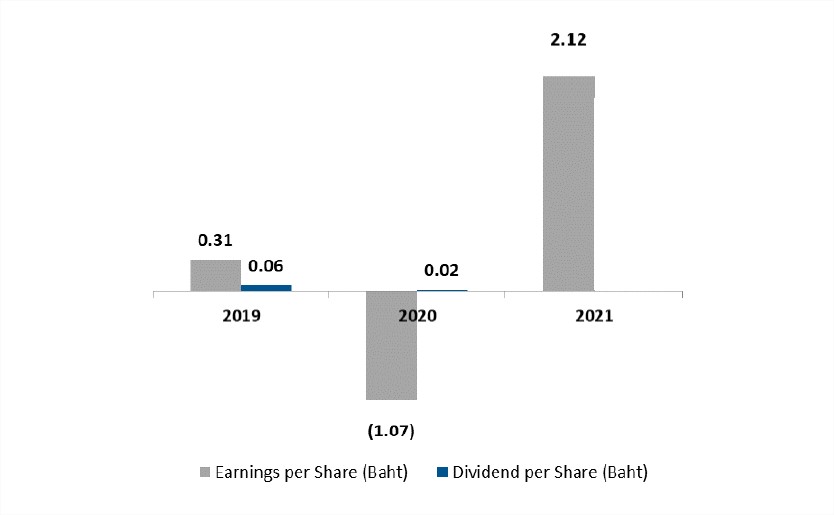

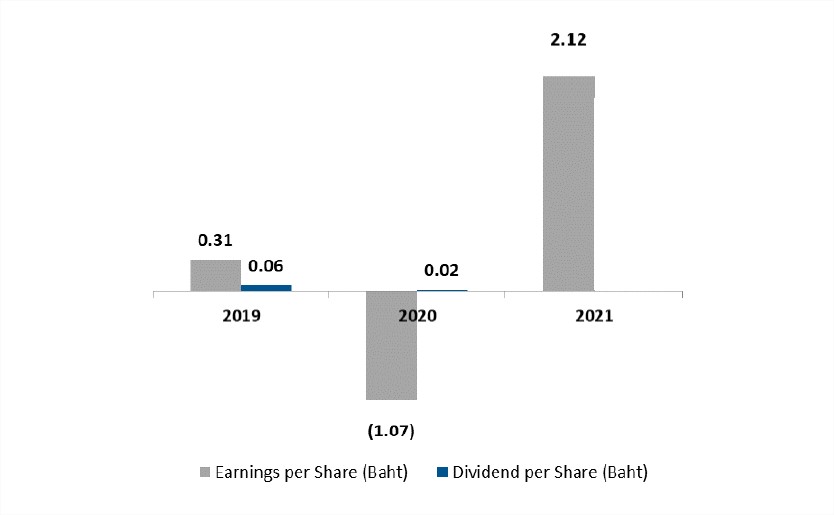

EPS and Dividend Payment |

||||

|---|---|---|---|---|

Earnings per Share (Baht) |

0.31 | (1.07) | 2.12 | |

Dividend per Share (Baht) |

0.06 | 0.02 | (12) | |

Number of Shares (Million Shares)* |

1,822 | 1,822 | 1,822 | |

*As the end of period

Note

(1) EBITDA = Earnings before interest, tax, depreciation, and amortization (excluding non-recurring items)

(2) Including holding and elimination

(3) Normalized net profits/ (losses) to TTA = Net profits/ (losses) to TTA – non-recurring items

(4) Cash, cash equivalents, and other current financial assets

(5) Property, plant, equipment, and investment properties

(6) Excluding lease liabilities

(7) Including amortization of vessel drydocking but excluding depreciation and other amortization

(8) Financial Covenant for TTA221A Debentures, of which threshold is 1.5 times.

(9) Debt to equity = (Interest bearing debt including lease liabilities - cash and cash equivalents)/ Total shareholder’s equity

(10) Financial Covenant for TTA233A, TTA239A, TTA252A, and TTA265A Debentures, of which threshold is 2.0 times.

(11) Net interest bearing debt to equity = (Interest bearing debt excluding lease liabilities – cash and cash equivalents – other current financial

assets)/ Total shareholder’s equity

(12) Subject to the approval of shareholders at the 1/2022 AGM on 27 April 2022