Bangkok, Thailand, 17 February 2014 -- Thoresen Thai Agencies Public Company Limited (“TTA” or “the Group”) announced its best first quarter results in five years, with net profits of THB 250 million for the period ended 31 December 2013. The turnaround result was driven by profitability in three out of the Group’s four core businesses, namely Mermaid Maritime Public Company Limited (“Mermaid”), Thoresen Shipping Singapore Pte. (“Thoresen Shipping”) and Baconco Co., Ltd (“Baconco”). The fourth core business, Unique Mining Service Public Company Limited (“UMS”) reported a loss of THB 35 million as a result of a new effort to rebalance the unit’s capital structure and strengthen its financial health.

MERMAID

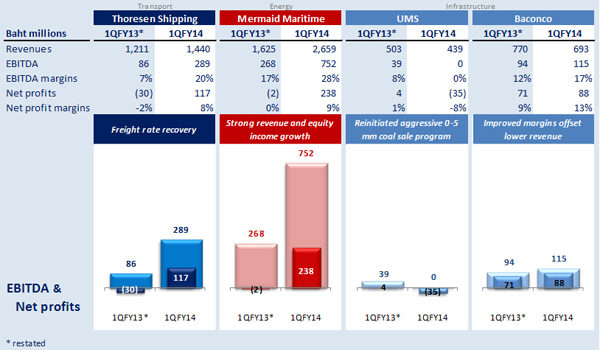

Mermaid also reported its strongest first quarter result in five years, reversing net losses of THB 2 million during the same period last year with net profits of THB 238 million. The strong result came on the back of robust performances in both its subsea and drilling segments.

Mermaid’s subsea business led the recovery as it secured more full service contracts at higher margins. An increase in achieved day rates and utilisation rates resulted in a 71% growth in revenues. The subsea fleet’s utilisation rate increased from 51% to 74% year-on-year.

Mermaid’s drilling business also performed well, as evidenced by a significant increase in equity income, which jumped from losses of THB 11 million in the first quarter of 2013 to profits of THB 234 million in Q1 2014. The result was driven by strong contribution from Mermaid’s 33.8%-owned associate company Asia Offshore Drilling (“AOD”) as all three of its high-specification jack-up rigs commenced their three-year contracts with Saudi Aramco.

THORESEN SHIPPING

Thoresen Shipping’s net profit surged 490% to THB 117 million, the unit’s strongest first quarter result in three years, on the back of higher day rates and an improved cost structure.

The unit achieved day rates of USD 10,446 per day compared to USD 7,542 during the same period last year as the dry bulk shipping industry began to recover from a prolonged cyclical downturn. Thoresen Shipping’s owner expenses of USD 4,057 per day remained well below the industry average of USD 5,121 while total costs dropped to USD 7,806 per day compared to USD 9,822 during the same period last year.

Overall, Thoresen Shipping’s EBITDA jumped 237% to THB 289 million, compared to THB 86 million during the same period last year.

UMS

Beginning in the first quarter of 2014, UMS refocused on rebalancing its capital structure and strengthening its financial status. To achieve this, the unit reinitiated a programme of aggressive 0-5 mm coal sales. As a result, the proportion of low margin 0-5 mm coal as part of UMS’s overall sales mix increased to 56% during the quarter, compared to 22% in the same period last year. This, combined with prolonged logistics inefficiencies at UMS’s Samut Sakorn plant put pressure on UMS’s margins, leading to net losses of THB 35 million. UMS continues to discuss a number of options with authorities to regain full logistic efficiencies via the use of its own port.

BACONCO

Baconco continued on its growth trajectory, boosting year-on-year net profits 24% to a record THB 88 million. Both its fertiliser and warehouse businesses delivered strong results compared to the same period last year. The fertiliser segment delivered higher year-on-year margins due to lower cost raw material sourcing and increased domestic marketing efforts. Baconco’s warehouse segment meanwhile, saw contributions nearly double a year-on-year, following the launch of Baconco 5 in February 2013.

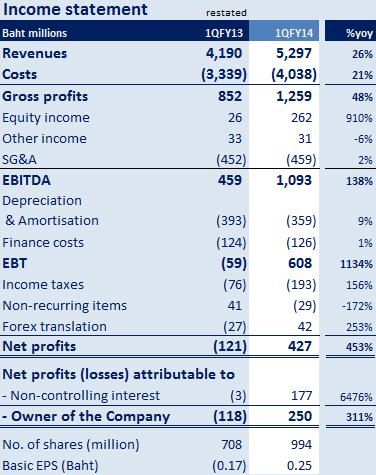

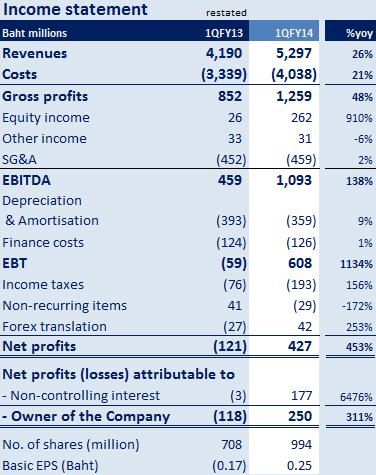

RESULTS

TTA’s net profits grew 311% year-on-year, compared with net losses of THB 118 million during the same period last year. The Group’s consolidated revenues rose 26% year-on-year to THB 5,297 million, while EBITDA jumped to THB 1,093 million, up 138% due to a combination of improving profitability margins across TTA’s businesses and a significant increase in equity income from AOD’s operation.

TTA President & CEO Mr. Chalermchai Mahagitsiri stated, “We are pleased to see that the efforts we have put into driving higher margins while maintaining advantageous cost structures across our portfolio of businesses have begun to bear fruit. The outlook for the rest of 2014 and beyond continues to show upside, and we expect resilient oil and gas exploration activity, sustained recovery in the dry bulk shipping industry, and growth in our Vietnam businesses to drive TTA’s results in the months and years ahead. Although the Thai Baht has recently decreased in value, our results have not been and are unlikely to be affected as nearly 80% of TTA’s revenues are collected in US Dollars.”

For Mermaid, we remain cautiously optimistic about the outlook for oil and gas services, given stable oil prices and continued exploration and production spending and going forward, will focus on securing more long-term and higher margin contracts. Mermaid’s recently concluded orders for two tender drilling rigs and one dive support vessel will allow the company to meet increasing demand when the assets are delivered in 2016. At the same time, we see tremendous opportunities for growth for Thoresen Shipping. With the support of our shareholders at the upcoming rights offering in March, we expect to grow our owned fleet to up to 30 vessels, depending on market opportunities and the relative investment attractiveness across TTA’s business groups.”

A major focus for improvement remains UMS, where we continue working towards regaining full access to our Samut Sakorn plant while also investigating a number of potential expansion plans, including international trading in markets like China. For Baconco, despite sustained strong performance, we continue to explore paths for growth in the company’s fertiliser and warehouse segments and in the third quarter, expect to unveil a new granular production unit, which will boost production capacity by approximately 100,000 tonnes.”

Attachments