Bangkok, Thailand, 16 May 2013 -- Thoresen Thai Agencies Public Company Limited (“TTA”) announced net losses of THB 257 million and losses per share of THB 0.33 for the second quarter of its 2013 fiscal year that ended on 31 March 2013, compared with net losses of THB 205 million and losses per share of THB 0.29 during the same period last year. The weaker results were mainly due to a continued environment of depressed dry bulk shipping freight rates affecting Thoresen Shipping Singapore Pte (“Thoresen Shipping”) and the unavailability of key assets at offshore oil and gas services provider Mermaid Maritime Public Company Limited (“Mermaid”).

Revenues for the quarter climbed 4% to THB 3,657 million compared to last year, but dropped 13% against the previous quarter, primarily due to four Mermaid vessels being dry-docked for various durations during the period.

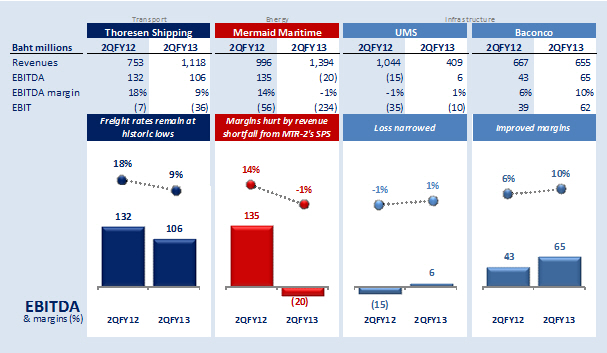

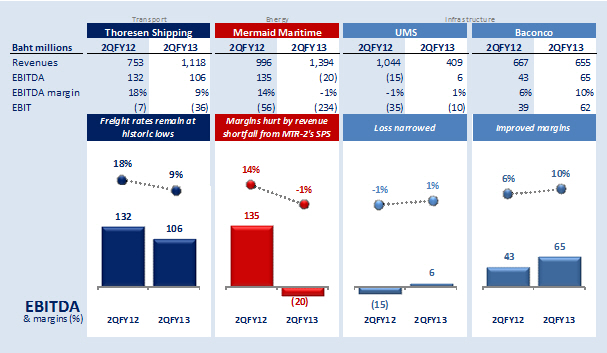

Baconco Co., Ltd. (“Baconco”), TTA’s wholly-owned fertiliser and warehouse business in Vietnam, maintained its strong performance with EBIT climbing 58% year-on-year while Unique Mining Services Plc. (“UMS”), which continued to manage its coal logistics business from one of two plants, operated at just below break-even during the quarter.

Commented TTA Executive Vice Chairman Mr. Chalermchai Mahagitsiri, “TTA’s relatively weaker second quarter performance is a temporary setback. For example, Mermaid’s results were impacted by the unavailability of some key assets, such as the MTR-2 rig, which was off hire for the entire quarter. The third quarter will see Mermaid operate with its full asset base, and we expect both subsea engineering and drilling to improve significantly, in turn driving stronger consolidated results.”

Group Transport

Dry bulk shipping companies worldwide continued to weather a tough operating environment. During the quarter, the index that tracks global freight rates, the Baltic Dry Index (“BDI”), fell by 8% year-on-year and 16% quarter-on-quarter.

Thoresen Shipping’s revenues rose to THB 1,118 million compared to THB 753 million during the second quarter last year, primarily as a result of more active chartering-in activity, which has increased over the last several quarters. Thoresen Shipping operated an average of 29.4 vessels during the quarter, compared to 16.3 vessels during the same period last year.

Despite the challenging environment, Thoresen Shipping still managed to operate its fleet with a positive EBITDA of THB 106 million, outperforming its fleet-adjusted industry benchmarks by 19% in terms of freight rates, while continuing to keep costs in the industry’s top quartile, with owner expenses dropping to USD 3,986 per day, 6% lower than the previous quarter and well below the industry average of approximately USD 4,500 per day.

The January-March quarter is typically the slowest for the dry bulk shipping industry, with freight rates usually rebounding after Chinese New Year. Halfway into the third quarter, freight rates for Supramax vessels have already risen by an average of approximately 16% compared to the second quarter.

Group Energy

The offshore services sector continues to be the beneficiary of a cyclical upturn in the oil and gas industry. Mermaid’s total revenues for the quarter were THB 1,394 million, a year-on-year increase of 40% but a drop of 14% against the previous quarter. MTR-2, Mermaid’s tender drilling rig, underwent a special periodic survey (“SPS”) from November 2012 through April 2013. The rig did not generate revenues during this period but continued to incur normal operating expenses. MTR-2 has completed its SPS and will resume drilling operations within one week in Indonesia.

During the same period, three vessels from Mermaid’s subsea engineering group were also off hire, as M.V. Mermaid Commander and M.V. Endeavour were dry docked for regularly scheduled maintenance, while M.V. Mermaid Asiana had to be refitted to begin servicing a five-year USD 530 million Inspection, Repair, and Maintenance (“IRM”) contract with Saudi Aramco.

Mermaid expects an improved third quarter on the back of high utilisation for its entire asset base. The subsea fleet is working across multiple geographic regions at enhanced day rates, as the company provides more value-added services and secures longer contract durations. The outlook for Mermaid’s drilling business also remains positive, with MTR-1 continuing to operate as an accommodation barge and MTR-2 commanding strong day rates of approximately USD 95,000.

Group Infrastructure

Group Infrastructure reported mixed results for the second quarter, as Baconco continued to generate strong profits and cash flows, while UMS remained in a difficult environment as a result of the prolonged closure of its Samut Sakorn plant due to community protests in a nearby district nearly 22 months ago.

On a consolidated basis, UMS’ net losses narrowed to THB 16 million in the second quarter from THB 43 million a year ago, as costs associated with selling its 0-5 mm coal stockpile decreased significantly year-on-year.

Following efforts to meet all conditions, the shutdown order of UMS’ Samut Sakorn facility was recently lifted, and UMS is expected to regain partial logistics efficiency once the plant is reopened. However, efforts by UMS to gain permission to utilise its own port at the Samut Sakorn facility are still on-going, which means that transport costs will only partially improve in the third quarter.

Baconco continued its strong performance in the second quarter, contributing THB 46 million in net profits, up 31% compared to the same period last year. Revenues of THB 655 million were down marginally year-on-year, primarily due to softer selling prices as Baconco sold almost 40,000 tonnes of fertiliser and crop care products, about 12% higher than the volume sold in the same quarter last year.

Following the completion of a new 27,000 square metre warehouse in January 2013, Baconco now boasts three warehouse facilities with a combined capacity of about 37,000 square metres, large enough to handle 140,000 metric tonnes of cargo. Overall, Baconco warehouses saw an impressive 80% capacity utilisation during the quarter. Warehouse rental revenues surged by approximately 70% year-on-year in the second quarter, but still make up a relatively small portion of Baconco’s overall revenues.

Outlook

“Global freight rates are picking up marginally, but we do not expect a strong rebound this year. This means our focus for the dry bulk shipping business will remain on operating on a positive cash flow basis, as we seek out opportunities to renew the fleet while vessel prices remain low,” concluded M.L. Chandchutha Chandratat, TTA’s President & CEO. “Mermaid’s prospects, despite a difficult quarter, remain positive, and we expect the proceeds of the Saudi Aramco deals for both Mermaid and Asia Offshore Drilling Ltd to begin making a bottom line impact in the third quarter. In the meantime, with the support of both provincial and local governments, UMS is now crossing its final hurdles towards the resumption of operations in Samut Sakorn, bringing the conclusion of a particularly difficult chapter in the company’s history within reach. While the second quarter brought with it its share of challenges, there is no doubt that the prospects for an improved second half remain solid.”

About TTA

Thoresen Thai Agencies Public Company Limited ("TTA") is a strategic investment holding company listed on the Stock Exchange of Thailand (TTA:TB). Its investment strategy is to grow through a balanced and diversified business portfolio of transport, energy, and infrastructure assets, both domestically and internationally. TTA's evolution away from a pure dry bulk shipping operator began in 1995 with an investment in Mermaid Maritime Public Company Limited, which has since been listed on the Singapore Stock Exchange (MMT:SP). Since then, TTA has acquired interests in fertiliser and logistics (Baconco Co., Ltd.), coal-related businesses (SKI Energy Resources Inc, Merton Group (Cyprus) Limited, and Unique Mining Services Public Company Limited), petroleum tankers (Petrolift, Inc), and a port in Southern Vietnam (Baria Joint Stock Company of Service for Import Export of Agro Forestry Products and Fertilizers). For more information, please visit www.thoresen.com