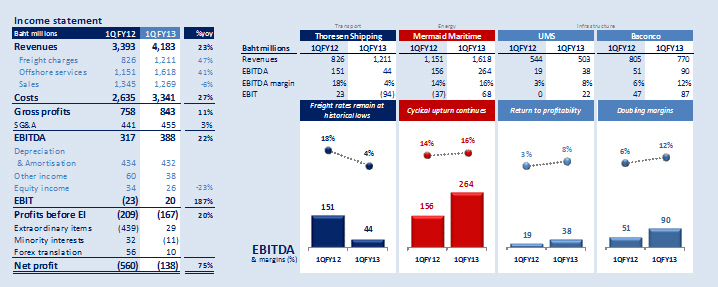

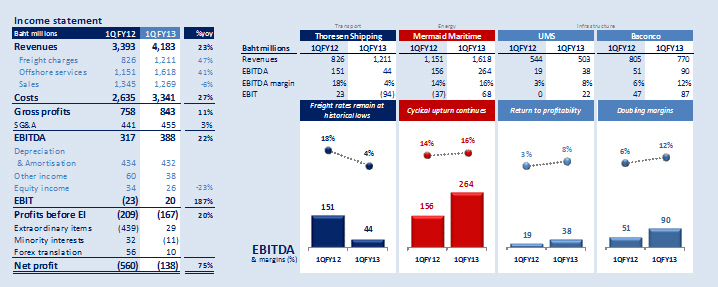

Net losses narrowed to THB 138 million, a 75% YoY gain Net cash flows from operations remain strong at THB 701 million Positive EBITDA contributions from all four core business units

Bangkok, Thailand, 15 February 2013 -- Thoresen Thai Agencies Public Company Limited (“TTA”) announced net losses of THB 138 million and losses per share of THB 0.19 for the first quarter of its 2013 fiscal year that ended on 31 December 2012, compared with net losses of THB 560 million and losses per share of THB 0.79 during the same period last year. On a normalised basis, earnings before interest and taxes (“EBIT”) rose 187% to THB 20 million from a negative contribution of THB 23 million the previous year.

The net improvement resulted from stronger performances at TTA’s three main non-shipping business units, as freight rates in the dry bulk shipping industry continued to fall. Higher margins were recorded at the Vietnam fertiliser business, Baconco Co., Ltd. (“Baconco”), offshore oil and gas services business, Mermaid Maritime Public Company Limited (“Mermaid”), and coal logistics business, Unique Mining Services Plc. (“UMS”).

Revenues for the quarter climbed 23% year-on-year to THB 4,183 million, mainly as a result of higher vessel days for Thoresen Shipping and better utilisation and day rates at Mermaid. Net cash flows from operations remained strong during the quarter, at THB 701 million.

Commented TTA Executive Vice Chairman Mr. Chalermchai Mahagitsiri, “We see continued evidence of a turnaround, and although the operating environment for dry bulk shipping remained very difficult for the entire industry, gains across our three other core business units helped to cushion the negative effects. These results support our strategic imperative to diversify revenue streams while we wait out a rebound in the dry bulk industry.”

Group Transport

Group Transport contributed a negative EBIT of THB 67 million, as the dry bulk shipping industry remained at or near the bottom of the industry cycle. During the quarter, the index that tracks global freight rates, the Baltic Dry Index (“BDI”), fell by 51% compared to the same period last year.

Thoresen Shipping’s revenues rose to THB 1,211 million, 47% and 19% stronger year-on-year and quarter-on-quarter, respectively. Revenues rose primarily as a result of more active chartering-in activity, as Thoresen Shipping operated an average of 28.5 vessels against an owned fleet of 16 vessels. The active chartering-in activity accommodated growing commercial relationships as Thoresen Shipping’s network of key clients and brokers continues to expand.

As global freight rates weakened significantly, Thoresen Shipping’s Time Charter Equivalent (“TCE”) rate fell to USD 7,540 per day, 32% weaker than the same period last year but still outperforming the relevant industry indices by 12%. As chartered-in vessels are positioned in higher yielding routes in the coming months, Thoresen Shipping’s results are expected to improve modestly.

Because Thoresen Shipping operates a modern fleet and completed its restructuring activities, total per-day operating costs have continued to decline, from a peak of over USD 14,000 in the fourth quarter of 2011 to about USD 10,000 in the first quarter of 2013. Furthermore, at USD 4,257 per day, owner operating expenses remained well below the industry average, which stands at approximately USD 4,500 – USD 4,600, enabling Thoresen Shipping to generate a positive EBITDA despite the difficult global freight rate environment.

Petrolift, Inc. (“Petrolift”)’s performance rebounded during the quarter as revenues regained strength toward the end of 2012 with several previously dry-docked vessels resuming work. During the first quarter, Petrolift reported a marginal 2% increase in revenues year-on-year while EBITDA grew in excess of 20% in Philippines Peso terms. As a result of a favourable exchange rate, Petrolift’s contribution to TTA grew by 26% compared to the same period last year.

Group Energy

Led by a continued turnaround at Mermaid, Group Energy contributed an EBIT of THB 68 million during the quarter, compared to a negative EBIT of THB 37 million for the same period last year.

Mermaid’s total revenues were THB 1,618 million, a year-on-year increase of 41%. Revenues from Mermaid’s subsea segment rose 53% year-on-year as a result of higher day rates. Drilling revenue was off by 7% compared to the first quarter of 2012, with MTR-2 beginning a four-month special periodic survey (“SPS”) after finishing an assignment in Indonesia in November 2012.

Mermaid continues to reap the benefits of a subsea fleet optimisation strategy that focuses on higher vessel yields and increased market penetration in high growth areas, such as the Middle East. This push materialised in several significant deals throughout 2012 and in the early part of fiscal year 2013, propelling Mermaid to report a positive EBIT of THB 68 million, compared to a negative EBIT of THB 37 million a year ago.

Group Infrastructure

Group Infrastructure contributed an EBIT of THB 123 million during the quarter, compared with THB 62 million during the same period last year. Baconco continued to generate strong profits and cash flows, while UMS gears up for the reopening of its Samut Sakorn plant in the second quarter after its stockpile of 0-5 mm coal was declared cleared, a major prerequisite put in place by the provincial government following community protests that affected all coal operators in the area.

Operating normally from its Ayudhya plant, UMS sold approximately 178,000 tonnes of coal during the quarter, about 18% lower than the volume sold in the same quarter last year when UMS was still aggressively selling its stockpile of 0-5 mm coal. However, revenues dropped by only 8% year-on-year, while gross margins improved from 15% to 24% during the same period, since the transportation costs UMS was forced to endure during the sales of its 0-5 mm coal were no longer necessary. EBIT for the quarter was THB 22 million, compared to THB 0.3 million during the same period last year.

Similar to UMS, Baconco’s sales dropped slightly during the first quarter, but profit growth was strong, as gross margins improved from 9% to 15% while EBIT rose from THB 47 million to THB 87 million a year later as Baconco’s efforts to source lower cost raw materials domestically bore fruit. Baconco’s logistics and warehouse business continued its strong performance, enjoying a capacity utilisation of over 90% during the quarter.

Outlook

“Over the next two to three quarters, we do not expect a rebound in global freight rates for dry bulk shipping, so the bulk of contributions will come from our other core business, led by Mermaid which has positioned itself solidly to capitalise on the multi-year cyclical upturn the oil and gas industry has now entered,” concluded M.L. Chandchutha Chandratat, TTA’s President & CEO. “While we expect a weak second quarter, performance is expected to pick during the second half of the year. At the same time, 2013 promises to be an important year for TTA, in which we make key opportunistic investments in both dry bulk shipping and offshore oil and gas services in order to ensure TTA’s future profitability for years to come.”

About TTA

Thoresen Thai Agencies Public Company Limited ("TTA") is a strategic investment holding company listed on the Stock Exchange of Thailand (TTA:TB). Its investment strategy is to grow through a balanced and diversified business portfolio of transport, energy, and infrastructure assets, both domestically and internationally. TTA's evolution away from a pure dry bulk shipping operator began in 1995 with an investment in Mermaid Maritime Public Company Limited, which has since been listed on the Singapore Stock Exchange (MMT:SP). Since then, TTA has acquired interests in fertiliser and logistics (Baconco Co., Ltd.), coal-related businesses (SKI Energy Resources Inc, Merton Group (Cyprus) Limited, and Unique Mining Services Public Company Limited), petroleum tankers (Petrolift, Inc), and a port in Southern Vietnam (Baria Joint Stock Company of Service for Import Export of Agro Forestry Products and Fertilizers). For more information, please visit www.thoresen.com